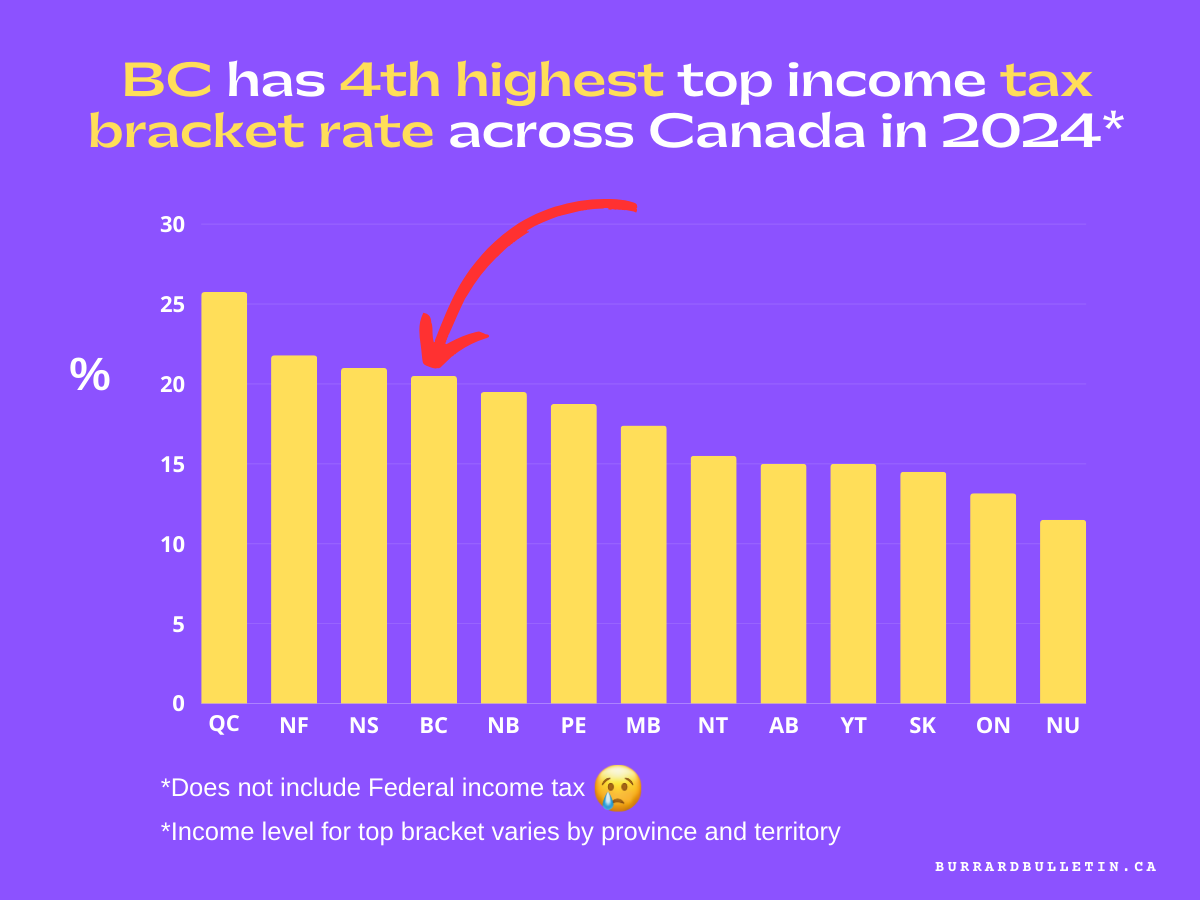

It’s Tax Time Canada – Here’s How Much You Owe in Each Province/Territory If You Made $1 Million in 2023

January is almost over which means it’s tax time. Yikes!

IMO, it’s getting to the point where there’s not a whole lot of incentive to make a lot of money. If you live in Nova Scotia, more than half your income goes to taxes.

WTF?

Serious question.

I know $250K is an enviable household income anywhere, including Canada, but more and more households are hitting that which means more and more folks are hitting high tax brackets.

I understand that only a small percentage of folks earn $1 million or more per year. The point of the table below is to illustrate the differences in how much tax you will pay as a high earner in different provinces. Let’s just say after you read this that it’s not only high real estate prices that’s a reason to move to another province… BC income tax is one of the highest in Canada.

Table: How much taxes owing if made $1 million in 2023

Interestingly, at the $1 million income level, taxes owing does not entirely correspond to the highest tax rates in the chart at the very top. For instance, Quebec has the highest tax rate but is third in total taxes owing.

| Province / Territory | Taxes Owing |

|---|---|

| Nova Scotia | $503,642 |

| Newfoundland & Labrador | $499,466 |

| Quebec | $498,843 |

| Ontario | $493,032 |

| New Brunswick | $486,774 |

| British Columbia | $486,564 |

| Prince Edward Island | $480,813 |

| Manitoba | $471,149 |

| Saskatchewan | $442,531 |

| Alberta | $440,893 |

| Yukon | $434,876 |

| Northwest Territories | $434,301 |

| Nunavut | $408,594 |

* The above does not take tax breaks, exemptions, capital gains, etc. into account. It’s straight-up taxable income.

Source: TurboTax online calculator